Pricing

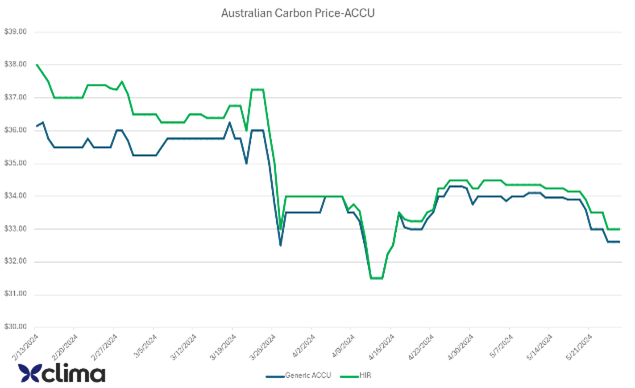

The Australian Carbon price traded in a range of around 7% for May thus far. There has been a large volume of forward trades done in the market as we see emitters and compliance buyers who have taken heed of the regulator’s warnings that the current pricing is reasonable.

| ACCU | Indicative Price | Monthly Range | 30 Day Volume | Relative Demand |

|---|---|---|---|---|

| Generic | $32.60 / 33.25 | $32.60 / 34.50 | >820k Tonnes | Very High |

| HIR | $32.80 / 33.45 | $33.00 / 34.50 | >150k Tonnes | High |

| Savanna Burning | $32.80 / 33.45 | $32.80 / 34.00 | >10k Tonnes | Stable |

| Indig Savanah | $49.00 / 53.00 | $50.00 / 53.00 | >10k Tonnes | High |

| Soil Carbon | $47 / 52.00 | $46.00 / 50.00 | <2k Tonnes | Developing |

| Env Plantings (25Y) | $50.00 / 53.00 | $47.00 / 54.00 | <5k Tonnes | Developing |

Gas and CCS and Multi-Year Monitoring Plans

Australia is moving towards a Gas and fossil fuel future. Sad but true and the ticket to play will most likely be the ACCU.

Remember carbon is hard to capture and when you do there is the big issue of where to put it. The Gas and coal lobby has managed to get the taxpayers to fund the folly into the Carbon Capture and Storage tech.

It can work if there are stable geological formations to accept Co2 often mixed with other harmful gasses and minerals. But more often than not CCS is technology washing to avoid action today. Another reason to fear the convexity of CCS failures and the possible price action of the market to respond.

The big news just out is that the QLD government has not approved a plan by Santos’s subsidiary CTSC to pump it into Australia’s most significant Aquifer the Great Artesian Basin. What a great victory for common sense by the farmers who lobbied against this folly.

You can read this as meaning that companies who had utilised the ‘kick the can down the road’ ploy of a credible decarbonisation path now have a problem. MYMP or multi-year monitoring plans for big gas and coal are starting to look a bit wobbly. Expect the directors to realise the disclosure risks of not adjusting to these precedents will lead to hedging needs. ACCU’s anybody?

Think you have nothing to worry about if you have a facility that has baseline below 100K Tonne. Think again Penny Sharpe and the NSW government is now placing new requirements for companies to have “credible plans to decarbonise’ for facilities. Revised assessment requirements and guidelines from the Environment Protection Authority mark a “foundational” tightening of rules for firms planning new projects or modifying existing ones that emit at least 25,000 tonnes of carbon dioxide equivalent a year, said Tony Chappel, the NSW EPA chief executive

Carbon Farming Industry Forum-Cairns

Clima was the official Offset Partner for the forum. The forum is nature-based removals focused and predominantly a place for emitters, developers, and carbon service providers to meet and discuss the market. There was some big themes that came through the market.

- Integrity

- Benefit-sharing

- New methods IFLM , Savanna Sequestration will continue to be slow to get approval (apart from a new Environmental Plantings method)

The big news was that Chris Bowen announced via VC that there is a new proponent-led methodology pilot. The window to enter a pilot Idea and an Expression of interest is July 12th.

The process has 5 main steps:

- Registering your new method idea.

- Submitting an EOI for a new method or method variation.

- Developing the method or method variation.

- Public consultation on the method or method variation.

- Finalising the method.

A great initiative albeit tactical to help move towards a strategic solution over the next 12-18m

The big takeaway from the conference. The lack of discussion on the price of carbon and the real costs of bringing projects to market in a high interest rate and cost of carry environment. It is an echo chamber of enthusiasm.

Many developers of carbon projects believe that their carbon should trade at a premium, but the big problem is none of the buyers who would be willing to pay a premium for those units attend these events. This leads us back to the big issue of supply.

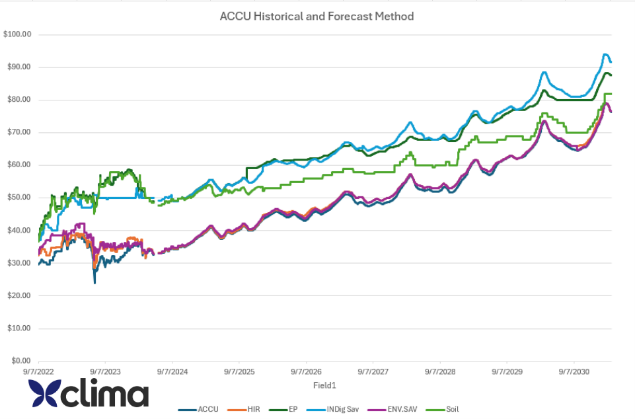

Registrations have been squeezed into methods deadlines, and the cost of progressing these projects with the current pricing is not justifiable at $33. We would expect to see disappointing issuance numbers going forward which will lead to increased focussed on delivered units being acquired.

Summary – “Hey Guy-Why hasn’t the price moved?”

The conundrum for market participants is this. Every month the market must digest more disappointing news about supply and methods. Huge issues are forthcoming around ILUA negotiations which I will save for another time which will further delay issuance. Demand is increasing and the technology paths to BAU through CCS etc are starting to look shakey despite billions of taxpayer funds being thrown at them.

In a world of increased transparency and integrity with time fleeting the outlook for the price of carbon remains robust in the medium term. As someone who understands how large organisations work, there is a glacial process of risk management that is permeating the compliance buyers in market. Patience is critical to seeing the price play the upside as the Australian Carbon market is inefficient and opaque. We are improving.

We are fixing the plane while we are flying it

The Carbon Guy