Introduction

You’ve likely heard phrases such as “mandatory climate-related disclosures are coming up” or “be ready for the ripple effect of climate-related disclosures.” But what exactly are climate-related disclosures? Which companies need to report? How is that going to affect your company? This guide will cover those questions and more.

Table of Contents

What exactly do we mean by climate-related disclosures?

The Australian Government is looking to introduce laws that impose mandatory requirements for large companies and institutions to publicly disclose the financial risks and opportunities associated with climate change and their strategies for addressing them (The Department of the Treasury, 2024). This aims to:

- Increase transparency among investors.

- Assist regulators in mitigating the risks to the global financial system posed by climate change.

- And most importantly, support Australia’s transition to net zero emissions by 2050, which is crucial for limiting global temperatures below 1.5°C, aligning with the Paris Agreement.

Let’s rewind to understand the beginnings of the new climate-related disclosures…

During COP26 in November 2021, the International Financial Reporting Standards (IFRS) Foundation announced the establishment of the International Sustainability Standards Board (ISSB) in response to policymakers’ call for consistent and high-quality global standards in sustainability reporting, aligning with financial reporting. In June 2023, the ISSB published its first two standards built on the work of different reporting initiatives, such as the Climate Disclosure Standards Board (CDSB) and the Task Force for Climate-related Financial Disclosures (TCFD). These two standards are:

Australian Government response to IFRS sustainability standards

“>The Australian Government approved the full adoption of IFRS S2, with some necessary modifications to suit the needs of Australia, and it supports the adoption of IFRS S1 as needed to implement climate disclosure standards (The Department of the Treasury, 2024).Therefore, using these standards as a foundation, the Australian Accounting Standards Board (AASB) published an exposure draft, ‘Australian Sustainability Reporting Standards – Disclosure of Climate-related Financial Information’ (ED SR1), in October 2023.The AASB ED SR1 includes three drafts of Australian sustainability reporting standards (ASRS):

The legislation process

Following the publication of this exposure draft, the Australian Government released a draft legislation specifying Australia’s climate risk disclosure framework. The draft legislation amends the ASIC Act 2001 (Cth) and the Corporations Act 2001 (Cth) to introduce mandated climate-related financial disclosures in a sustainability report. This report should be separate from the financial report but included within the company’s annual report. Additionally, similar to the financial report, the sustainability report needs to be audited. However, it is still up in the air if the auditor has to be the same person or just the same firm (BDO Australia, 2024).

On 27 March, the Australian Government introduced the Treasury Laws Amendment (Financial Market Infrastructure and Other Measures) Bill into Parliament. This Bill requires entities obligated to prepare and lodge financial reports with ASIC under Chapter 2M of the Corporations Act 2001 (Cth) to report climate-related risks and opportunities (not all sustainability matters).

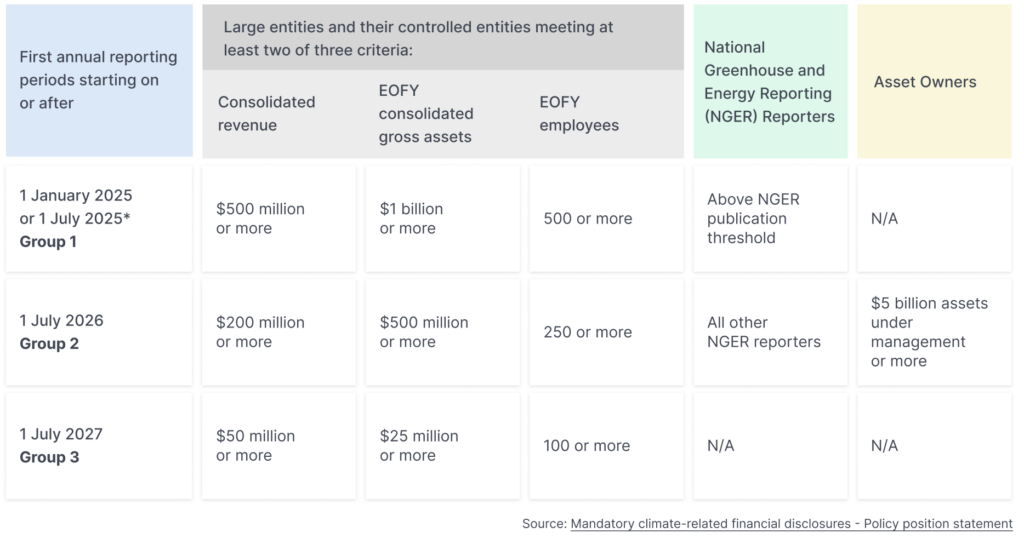

Who falls under the scope of mandatory climate reporting?

“>*Contrary to the initial draft legislation, which set July 2024 as the start date for Group 1, the Bill pushes back the start date for these entities. Here are the possible scenarios:

- If the legislation receives Royal Assent by 2 December 2024, the new start date for Group 1 entities shifts to years beginning on or after 1 January 2025.

- If the Bill passes through both houses of parliament after 2 December 2024 and before 1 June 2025, Group 1 entities could receive an additional full year, with the new start date set for 1 July 2025.

- In a less likely scenario, if the amendments proposed in the Bill take effect on or after 2 June 2025, Group 1 entities could start reporting on 1 July 2025, as long as it’s at least 29 days after the start date of the amendment, or 1 January 2026 (Boshoff, 2024).

What if your company is not subject to mandatory reporting?

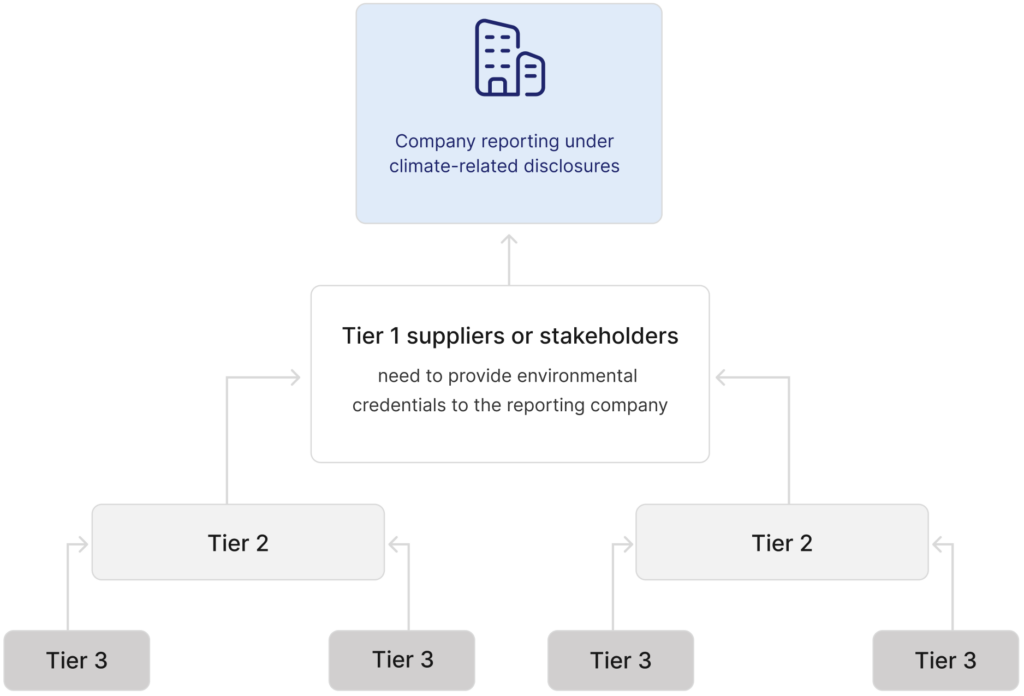

Most small to medium enterprises (SMEs) will probably not fall into these groups and, therefore,

will not be required to disclose their climate-related risks and opportunities directly. However, this does not mean these companies should not start acting. When SMEs provide services to larger companies,

they contribute to those companies’ Scope 3 emissions. Hence, SMEs might end up reporting their emissions to larger companies so that the latter can account for them in their disclosures.

This illustrates the ripple effect of environmental accountability across the value chain.

Once the laws come into effect, ASIC will provide further guidance for SMEs regarding the requirements and impacts of the legislation on them (ASIC, 2024).

What kind of information needs to be included in climate reports?

As previously mentioned, the objective of climate-related financial disclosures is for entities to disclose their climate-related risks and opportunities. But what does this mean?

Climate-related financial risks for the entity

This refers to the potential negative effects of climate change on an entity’s cash flows, access to finance or cost of capital, and its ability to further its objectives over the short, medium or long term. These climate-related risks may be either physical or transition in their nature, as stated in the Draft ASRS 2:

- Physical risks come in two forms: event-driven (acute) and longer-term shifts (chronic). Acute risks occur from severe weather events like storms, floods, droughts, and heatwaves, which are becoming more severe and frequent. Chronic risks, on the other hand, arise from gradual changes in climate patterns, such as shifts in rainfall and temperature. These changes could result in rising sea levels, reduced water availability, loss of biodiversity, and changes in soil quality. Physical risks can harm finances by damaging assets and disrupting supply chains. They can also affect the goals of for-profit and non-profits by impacting water availability, quality sourcing, operations, transportation, and employee well-being due to extreme temperature changes.

- Transition risks arise from the progression to a lower-carbon economy. These risks include changes in policy, technology, markets, and reputation. They can affect a business’s finances by increasing operational costs or reducing the value of assets because of new climate-related rules. Additionally, both for-profit and not-for-profit organisations can be affected by changes in what customers want and the introduction of new technology.

Climate-related financial opportunities for the entity

This refers to the potential positive effects of climate change on an entity’s cash flows, access to finance or cost of capital, and its ability to further its objectives over the short, medium or long term, as stated in the Draft ASRS 2. For example, increased revenue from products and services aligned with a lower-carbon economy.

According to both IFRS S1 and IFRS S2, as well as AASB, a company needs to disclose information in four key areas that are consistent with the TCFD:

| Governance | Strategy |

| – The governance processes, controls and procedures an entity uses to monitor, manage and oversee climate-related risks and opportunities. – For example, the entity should disclose who is in charge of managing the climate risks and opportunities. | – The approach to handling climate-related risks and opportunities. – For example, how climate-related risks and opportunities might impact the company’s business model and value chain, the strategies to tackle them, and the resilience of these strategies in adapting to the uncertainties of climate change. |

| Risk Management | Metrics and Targets |

| – The process a company has for identifying, assessing, and prioritising these risks and opportunities. – For example, the company’s approach to assessing the likelihood and magnitude of those risks. – Companies also need to include a climate-related scenario analysis to identify and assess different outcomes of future events under conditions of uncertainty. | – The entity’s performance in relation to climate-related risks and opportunities, including any progress towards targets. – For example, the total greenhouse gas (GHG) emissions generated during the reporting period (scopes 1, 2 and 3), targets set and progress towards those targets. |

You can’t manage what you don’t measure…

While the AASB ED SR1 mandates disclosures across various areas, one consistent metric for all companies is to disclose their carbon footprint. If you’re unsure where to begin in terms of strategy or risk management, start with understanding your emissions.

The AASB ED SR1 specifies that an entity would need to disclose:

| Scope 1 |

| Direct GHG emissions following the methodology of the National Greenhouse and Energy Reporting (NGER) Scheme legislation using Australian-specific data sources and factors. When the methodology in the NGER Scheme is not practicable, companies may report emissions following the GHG Protocol. |

| Scope 2 |

| Location-based scope 2 GHG emissions following the methodology of the NGER Scheme legislation using Australian-specific data sources and factors. Additionally, contrary to IFRS S2, the AASB ED SR1 also requires entities to disclose market-based Scope 2 emissions if required under the NGER legislation and for financial years that begin on or after 1 July 2027 at the latest. When the methodology in the NGER Scheme is not practicable, companies may report emissions following the GHG Protocol. |

| Scope 3 |

| Scope 3 emissions from an entity’s second reporting period onwards based on the GHG Protocol Scope 3 categories. Considering the challenges of calculating Scope 3 emissions, the AASB ED SR1 provides additional relief by allowing companies to disclose in the reporting period their Scope 3 emissions using data from the immediately preceding reporting period if reasonable data for the current period is unavailable. Given that the measurement of scope 3 emissions would likely include estimations, the AASB ED SR1 states that entities should disclose all of these assumptions or estimations. |

Liability

The Bill introduces expanded legal protections beyond what was initially proposed in the draft legislation.

For financial years (FY) starting within the first 12 months after the enactment:

- Limited immunity is granted to forward-looking climate statements made in sustainability reports that comply with climate-related reporting standards.

For financial years starting within three years after the enactment:

- Directors will receive limited immunity provisions when declaring, in their opinion, whether the entity has taken “reasonable steps” to ensure that the substantive provisions of the sustainability report comply with the Corporations Act 2001 (Cth).

- Limited immunity is provided for statements regarding Scope 3 GHG emissions, a climate-scenario analysis, and a transition plan.

Limited immunity will also be available to entities that choose to adopt the ASRS early or voluntarily during the limited immunity periods as long as their sustainability report complies with the standard. However, limited immunity does not apply if it is criminal in nature or brought by ASIC.

Early ASIC guidance on the mandatory climate disclosure regime

A keynote speech by ASIC Chair Joe Longo on 23 April 2024 provided some early guidance on the mandatory climate disclosure regime in response to growing concerns regarding climate-related disclosures. Below are some key points mentioned:

ASIC will develop and issue guidance on climate-related disclosures and will include resources on the ASIC’s website.

Companies cannot wait until after the legislation has passed. They must start creating a plan now.

Companies are encouraged to report voluntarily following the recommendations of the TCFD while there is more guidance on climate-related disclosures. ASIC considers that companies reporting under TCFD will be prepared to report under different standards. However, companies are also encouraged to become familiar with ISSB standards.

Climate-related reporting will impose new obligations but will also create opportunities for companies by bringing more transparency across capital markets.

ASIC acknowledges that the climate space is constantly evolving, and they are also learning from it.

References

- ASIC. (2024). Climate reporting and greenwashing: What small businesses need to know. https://asic.gov.au/about-asic/news-centre/articles/climate-reporting-and-greenwashing-what-small-businesses-need-to-know/

- Australian Accounting Standards Board. (n.d, n.d). About the AASB. https://aasb.gov.au/about-the-aasb/about-the-aasb/

- BDO Australia (Director). (2024). Understanding carbon accounting and why it is important https://youtu.be/TfY1_j_eicE?si=uOaG4AQvCUEB7Ko-

- Boshoff, A. (2024). Mandatory climate reporting in australia faces delay. https://www.bdo.com.au/en-au/insights/esg-sustainability/implementation-of-mandatory-climate-reporting-in-australia-faces-delay

- IFRS Foundation. (2024). IFRS – ISSB: Frequently asked questions. https://www.ifrs.org/groups/international-sustainability-standards-board/issb-frequently-asked-questions/

- The Department of the Treasury. (2024). Mandatory climate-related financial disclosures – policy position statement. https://treasury.gov.au/sites/default/files/2024-01/c2024-466491-policy-state.pdf