The Australian Carbon market is growing, regardless of the criticisms being thrown at it. Supply is constrained due to the enhanced integrity focus. Regulatory obligations are better understood, and the market will continue to grow and bring new innovative financial products to the table.

Australian Carbon Pricing

| ACCU | Current Price | Monthly Range | 30 Day Volume | Relative Demand |

|---|---|---|---|---|

| Generic | $33.25 / 33.75 | $32.50 / 36.00 | >700k Tonnes | High |

| HIR | $33.75 / 34.25 | $33.00 / 37.25 | >350k Tonnes | Increasing |

| Savanna Burning | $33.50 / 34.50 | $34.00 / 37.70 | >30k Tonnes | Increasing |

| Indig Savannah | $50.00 / 52.00 | $50.00 / 53.00 | >30k Tonnes | High |

| Soil Carbon | $52.00 / 55.00 | $46.00 / 50.00 | <5k Tonnes | Developing |

| Env Plantings (25Y) | $50.00 / 54.00 | $47.00 / $52 | <5k Tonnes | Stable |

The Australian Carbon price has had a volatile month. There was a rally in mid-March as there were denied rumours of the much-touted IFLM method being scrapped due to the inability to reconcile the complexities of the method. This was then followed up with a rehash of the integrity issues that have been following the HIR methodology. The ABC (Andrew Macintosh) and The Guardian both running articles.

The market traded a monthly range of $32.50 – $36.00 or around 10.7% price spread in generic ACCU’s with record-breaking volumes.

Main methods of pricing to date and 12m forecast

Chart: Main methods of pricing to date and 12m forecast

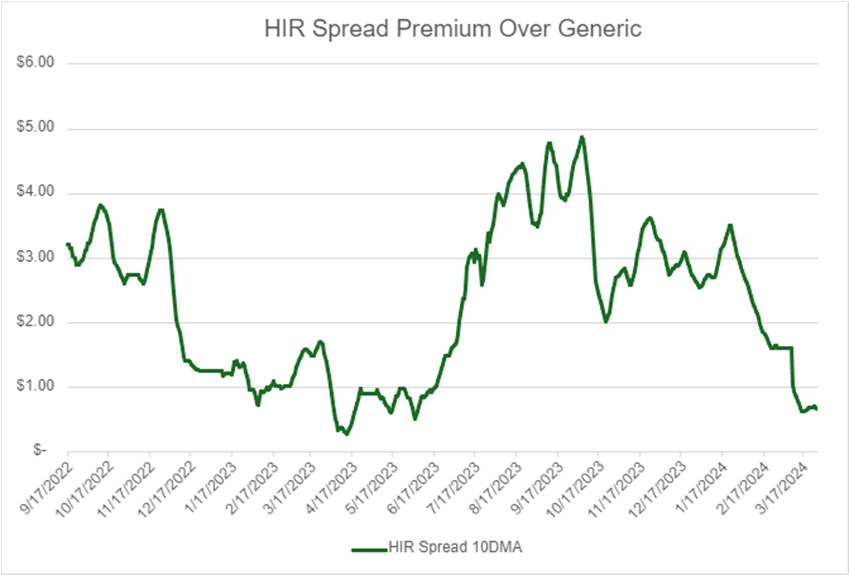

The spread of the various ACCU methods compressed mid-month and then extended as the price of Generic ACCU fell. It can be seen from the chart below that the spread has been tightening due to the increased pricing of the generic unit.

HIR spread premium

Chart: HIR spread premium over generic

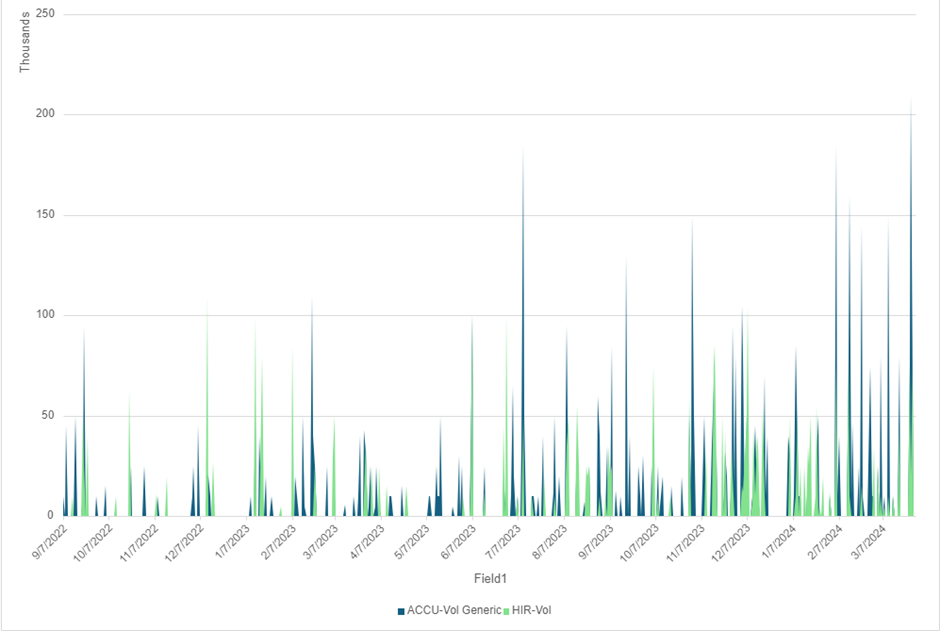

Record Australian Carbon volumes traded

Record volumes traded in the market in both the amount of the units traded and the total value of reported OTC turnover, for the month of March. This is represented below by two charts in the generic and HIR market. Much of the volume can be attributed to the following:

- New emitters opening ANREU accounts and beginning hedging activities.

- New speculative positions being added on the back of IFLM news.

- Capitulation of fresh trading positions on the back of the HIR integrity issues.

Generic and HIR volumes

Chart: Generic and HIR volumes

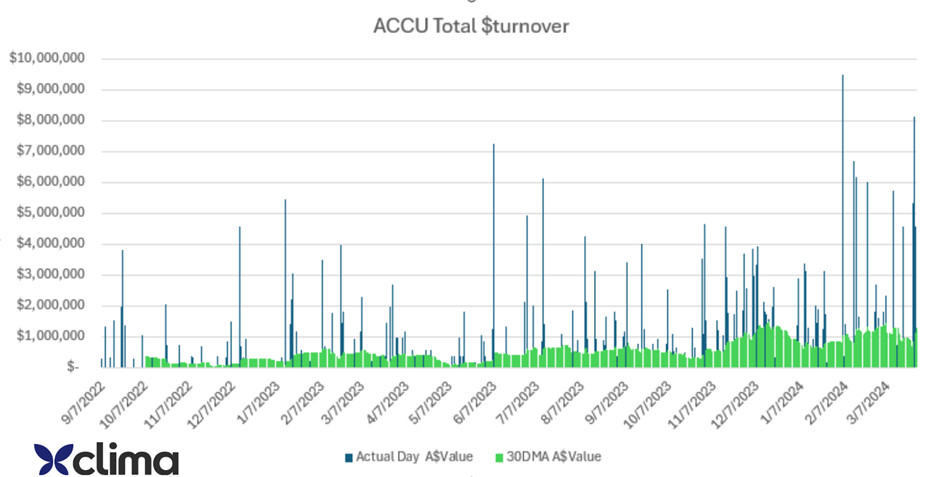

Daily Total Market $Value and 30 DMA

Chart: Daily Total Market $Value and 30 DMA

Disclaimer: The information provided, including any articles, reports, or other content, is for informational and educational purposes only and does not constitute financial advice. While we make every effort to ensure the accuracy and reliability of the information provided, Clima does not warrant or guarantee the completeness, accuracy, or reliability of any information or content. The information provided is subject to change without notice. You should seek advice from a qualified professional before making any financial decisions. Clima will not be liable for any loss or damage of any kind arising from the use of this or reliance on any information provided herein.