The Australian Carbon market has begun to see more robust purchases as we approach the end of the year. Demand and supply are equally matched as sellers lock in cash flow at the year’s end and emitters start to accumulate.

| ACCU | Bid | Offer | Supply | Demand | Delivery Risk | Reported Volume Tonnes |

|---|---|---|---|---|---|---|

| Generic | 32.10 | 32.60 | High | High | Low | 95K |

| HIR | 35.10 | 35.45 | High | High | On watch | 300k |

| Savanah | 36.50 | 37.25 | Low | Low | Moderate | Nil |

| Indig Savanah | 50.00 | 51.00 | Low | High | Moderate | Nil |

| Soil Carbon | 38.00 | 41.00 | Low | Building | Moderate | Nil |

| Reforestation (EP) | 62.00 | 65.00 | Low | High | Low-Moderate | Nil |

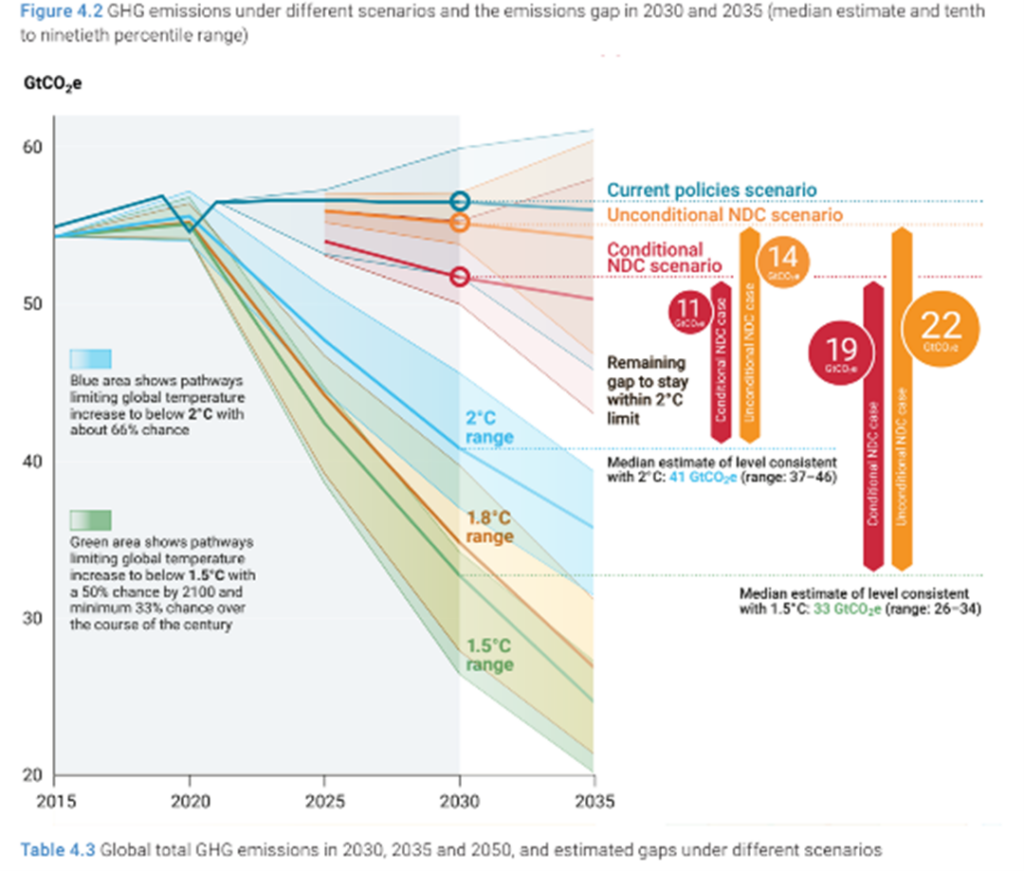

With the COPout 28 now wrapped up, we remain somewhat unchanged despite the convergence of the world’s 70,000 climate experts. With the watered-down commitments around fossil fuel phase-out and the seeming relentless need for status quo we can expect carbon markets to increase in relevance.

Fossil Fuels will not be phased out in line with the 1.5-degree trajectory. Love them or hate them carbon markets are here to stay and they are part of the transition toolbox and landscape.

It wasn’t all bad, with integrity peak bodies and the large global registries coming together in the hope to harmonise standards. This will not happen overnight but it’s the right thing to do.

Article 6 was a big thematic as always and there have been some more proactive moves in countries such as Singapore who have struck some deals in Africa and Indo Pac- PNG in particular.

Papua New Guinea is a country of enormous carbon removal potential. It will require a careful and consistent national strategy to help deliver great outcomes and meet its potential. Australia has a scheme called IPCOS and Papua New Guinea was hoped to be one of the pilot countries. IPCOS is the Indo Pacific Offset Scheme, and the idea was to export Australian best practices to potentially import carbon units into the Australian Scheme.

An excellent concept and with the recent security alliance we may start to see more interaction in this space into 2024/2025.

Clima notes two important thematics that have emerged over the H2 2023.

1 – Origin matters

Directors, clients, and customers all want carbon that has a guarantee of outcome or in some way mitigates risks around compliance.

If we think about what this means, when it comes time to buy carbon the bigger the client more important transparency is as a public company. The higher volumes there are for high-quality units.

2 – Quality Supply is constrained

If we look at the expectation of the major methods to deliver supply in the future, there are multiple speed bumps to contend with. Soil Carbon holds great potential but is there a risk that when developers are suggesting that the outcome of the method creates improved outcomes, is there really a need for the carbon finance to implore farmers to do it. Is there an additionality time bomb here? IFLM the new method to replace HIR holds promise but without a definitive date for delivery, we watch the days tick by.

Australian Blue Carbon, the unicorn of the nature-based carbon markets is too expensive. The price signals from the industry suggest $100 pricing against other alternatives leaves actual demand for units to not meet the feel-good expectation of Blue Carbon.

Environmental Plantings, considered one of the best in class will struggle to meet its volume potential under the current construct as people start to ask the question of what happens at the end of 25 years and land opportunities remain constrained.

Upstream realities and perceptions are starkly in contrast with the optimistic modelling of the downstream spreadsheet warriors.

Now I don’t want you to think that this means Clima is losing faith in the carbon markets. It is actually the opposite. With a continued supply challenge overlayed with the high expectation that everyone wants a quality unit, the asset class will likely experience material repricing in the next few quarters to rebalance these dynamics. Some simple modelling suggests that we hit a supply crunch of quality units towards H2 2025. Basic spreadsheet models are looking at 2028/2029 as that point of inflection.

What does this mean for companies that will increasingly utilise the carbon markets as more climate disclosures start to seep down the national and global supply chains? Companies that utilise Climate Active- Australia’s carbon-neutral standard to demonstrate their commitment to superior environmental outcomes. The vast majority of ACCUs purchased for Climate Active are considered high-integrity units that brands can confidently display. What if most of the units that have been available in the past are all of sudden scooped up by the bigger players who have teams of people to identify the quality projects and balance sheets to forward purchase.

The dream of a liquid Australian Carbon market flush with high-integrity credits/offsets that anyone would be proud to own at an observable price is a mirage. You need a partner.

There are wonderful opportunities for companies to take an early mover advantage. The first step of course is to become informed. https://blog.clima.com.au

Call the team at Clima to explore Investments in first-class upstream project development opportunities, across Nature and tech solutions, as well as the world’s largest range of Australia Carbon credits & quality carbon offset opportunities globally available for sale. From Mildura to Mozambique we have you covered.